refund for unemployment tax credit

Refer to FUTA Credit Reduction on the IRS website for more information. However not everyone will receive a refund.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

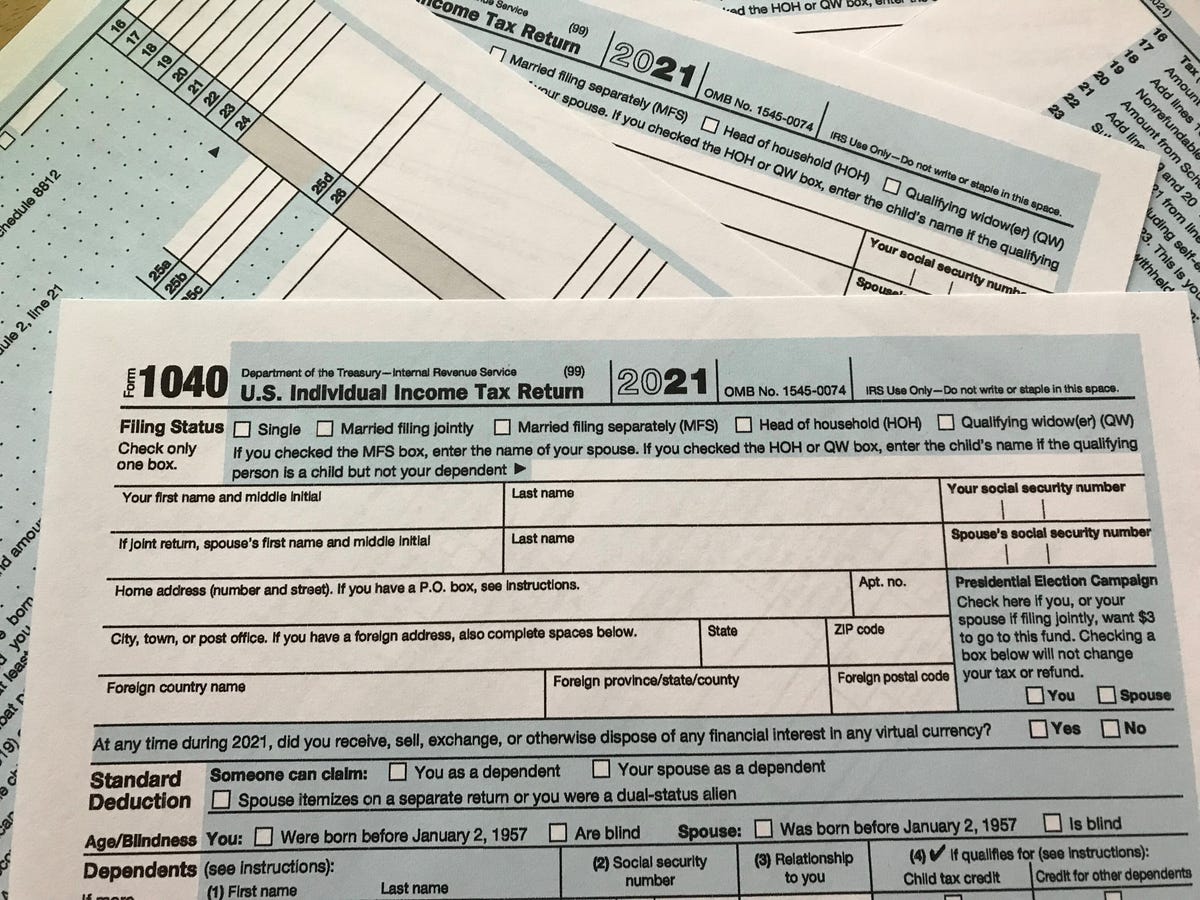

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

. So far the refunds have averaged more than 1600. IRS sending unemployment tax refund checks The law that made up to 10200 of jobless income exempt from tax took effect in Mar. This includes unpaid child support and state or federal taxes.

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Millions of Americans who collected unemployment benefits last year and paid taxes on that money are in line to receive a federal refund from the IRS this week.

Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits If you received unemployment benefits in 2020 a tax refund may be on its way to you The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. IR-2021-159 July 28 2021.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. For those early returns the IRS is making adjustments from its side and people dont need to do anything to get the refund. This is not the amount of the refund taxpayers will receive.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Select the name of the vendor who submitted the refund check. The unemployment tax refund is only for those filing individually.

Protecting yourself against unemployment fraud. The agency said last week that it. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

In the For Period Beginning field enter the first day of the pay period that the refund affects. This tax break was applicable for. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities.

The agency is also making corrections for the earned income tax credit premium tax credit and recovery rebate credit affected by the exclusion. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200. President Joe Biden signed the pandemic relief law in March.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. The IRS will issue refunds in two phases. The IRS has identified 16.

But the unemployment tax refund can be seized by the IRS to pay debts that are past due. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support. It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. Many people had already filed their tax returns by that time.

In the Refund Date field enter the deposit date. Generally you can take a federal credit against your FUTA tax for the UI taxes you paid to California. The IRS has sent letters to.

To report total taxable UI wages and pay any federal unemployment taxes you must file reports and pay UI taxes with us and file a Form 940 with the IRS. Check For The Latest Updates And Resources Throughout The Tax Season.

Interesting Update On The Unemployment Refund R Irs

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Personal Loans Loan Types Of Loans

When Will Irs Send Unemployment Tax Refunds 11alive Com

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Will There Be A Second Stimulus Verify And In That Case When What We All Know At The Moment Cnet 10 Things Who Website

Don T Make These Tax Return Errors This Year

Average Income Tax Preparation Fees Increased In 2015

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Snap Kept Over 2 Million Children Out Of Poverty Click Through To Read More Poverty Healthcare Education Poverty Children

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

6 Questions To Ask Your Cpa Via Gmlcpa Small Business Tax Road Tax Business Tax

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

Pin On Things That Should Make You Go Hmmm

Stimulus Check Status Update Irs Payment Timeline What To Know About Plus Up Money Irs Payment Schedule Filing Taxes

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping